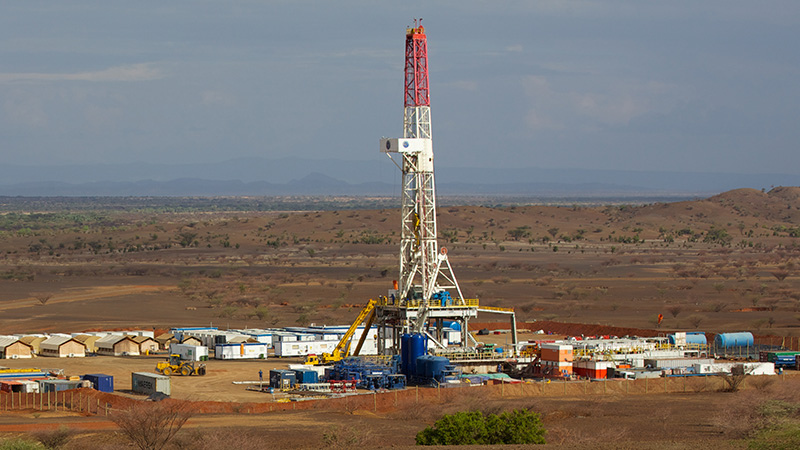

Waiting for Godot: Turkana’s Oil and the Residents’ Unending Wait

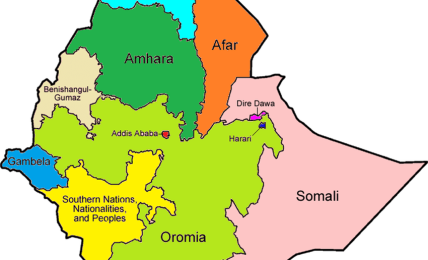

Kenya will not join the league of oil producing countries in the world despite the decade long activities of Tullow Oil Plc that had made residents of Turkana harbor hopes of prosperity.